Dynamic Wealth Design

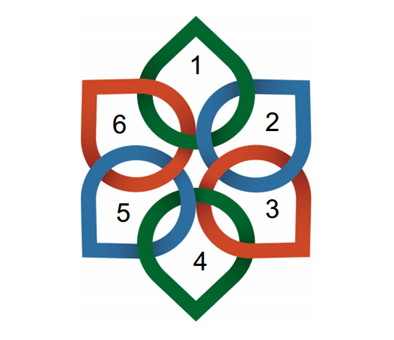

Here at The Normandy Group, our CERTIFIED FINANCIAL PLANNER™ professionals created a financial paradigm called a Dynamic Wealth Design. This paradigm has emerged over decades of work in combination with clients and collaborative partners. A Dynamic Wealth Design is living and breathing, just like our clients. As peoples’ lives change, so do their goals. Our Dynamic Wealth Design is built to anticipate and endure the inevitable changes life brings. Each element within the design plays an essential role in the financial planning process along with the collaboration of strategic partners. These may include a client’s estate planning attorney, tax professional, and other key advisors. The objective is to create a collaborative environment with a determined focus on successful outcomes. The Normandy Group’s logo is symbolic of our Dynamic Wealth Design. Let’s take a look:

Each petal of the logo represents a component of the Dynamic Wealth Design. The goal of each component is as follows:

- Maximize Control

- Assure Lifestyle

- Protect from Creditors & Predators. Leave a sense of personal responsibility to your heirs and community

- Minimize or avoid Income, Capital Gains, Gift and Estate Taxes

- Plan for the value of a business

- Organize Investment and Insurance Portfolios

By developing and implementing strategies to address each component within the design, the opportunity to create a financial foundation that can help one to live their best life can be realized. The CERTIFIED FINANCIAL PLANNER™ professionals at The Normandy Group are focused on assisting clients in accomplishing their goals for, at, and throughout retirement. We understand that life is full of uncertainty and an effective way to prepare for and manage uncertainty is through a process that is as dynamic as you are.

It is our belief that creating and adhering to a plan of action can bring peace of mind when adversity strikes. The years 1987, 1998, 2001, 2008, are excellent examples of this. More recently, 2020, the beginning of a pandemic demonstrated that major short-term volatility to the downside might not have a significant effect on longer term goals. By regularly updating financial objectives and working the plan, our Dynamic Wealth Design offers a potential to overcome vulnerabilities induced by disruptive economic events. Our Dynamic Wealth Design is customized to individual aspirations and is optimized for clients to live with confidence.

As we head into 2022, The Normandy Group will be creating a series of videos which will focus on our Dynamic Wealth Design. Please keep an eye out for them as we release them periodically on our YouTube channel, The Normandy Group. We will also be posting them in a video section on our website, www.normandygroup.com. Our goal is to provide short, engaging, and educational videos. If you find the content interesting, please do not forget to like our videos and subscribe to our channel. We encourage people to share these videos with others who may find them useful.

The CERTIFIED FINANCIAL PLANNER™ Professionals and Certified Estate Planners™ at The Normandy Group offer serious financial insights for today’s complex world. By combining investment, tax, risk transference techniques and estate planning strategies we can help you to provide clarity to your goals. Contact us today for a complimentary consultation.

The Normandy Group Team is ready to quarterback your wealth planning needs now and into the future. Thank you for your continued confidence and trust.

Download our free eBook “6 Simple Steps to a More Confident Retirement”: